Universal Creative Solutions has provided consulting services for over 15 years, helping organizations across various industries become and stay profitable. Through our extensive experience working with clients, we have always focused on the primary factors determining a business's profitability: Customer Acquisition Cost (CAC), Lifetime Value (LTV), Customer Churn Rate (CCR), and Cost to Serve (CTS). These metrics are interconnected, and changes in one can significantly impact the others.

Mastering profit margins requires a holistic approach to understanding, implementing, and optimizing these key metrics. Businesses should track and analyze data across the customer journey, from acquisition to retention, to identify areas for improvement and make data-driven decisions.

At Universal Creative Solutions, our consulting services focus on helping clients accurately track, analyze, and optimize these critical metrics. By leveraging data analytics and industry best practices, we empower businesses to enhance their marketing efforts, reduce churn, and ultimately increase profitability.

This article will explore these metrics, their definitions, calculations, benchmarks, and optimization strategies. We will also discuss how these metrics impact each other and share real-world examples from our consulting experience. By the end, you will have a comprehensive understanding of how to become a master of profit margins by optimizing your CAC, LTV, CCR, and CTS.

Defining the Key Metrics

To effectively optimize your business for profitability, it is essential to understand key metrics that impact your bottom line. These metrics provide insights into the health of your business to help you make data-driven decisions for improving profit margins. Let's define each of these critical metrics:

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) refers to the cost of winning a customer's purchase of a product or service. These costs include all marketing, sales, salaries, commissions, bonuses, and overhead expenses. Calculating your Customer Acquisition Cost (CAC) is a straightforward process that divides your total sales and marketing expenses by the number of new customers acquired over that period. The formula for CAC is as follows:

CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired

To accurately calculate your CAC, it's essential to understand the components of this formula:

Lifetime Value (LTV)

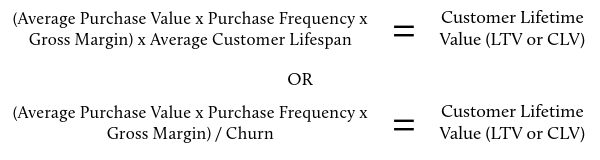

Lifetime Value (LTV) is the predicted net profit from the entire future relationship with a customer. Calculating LTV helps you understand the long-term value of your customers to make informed decisions about customer acquisition or retention strategies. The formula for LTV is as follows:

LTV = (Average Revenue per Customer / Churn Rate) x Gross Margin

In this example, each customer's lifetime value is $1,400, meaning that, on average, you can expect to generate $1,400 in net profit from each customer throughout their relationship with your business.

Industry benchmarks for LTV can vary widely depending on the sector and business model. Here are some general guidelines:

- Ecommerce: $100-$500 per customer

- SaaS: $1,000-$5,000 per customer

- Enterprise Software: $10,000-$50,000 per customer

- Consumer Goods: $50-$200 per customer

To maximize your LTV, focus on strategies that increase customer retention, such as providing excellent customer service, continuously improving your product or service, and implementing loyalty programs.

Customer Churn Rate

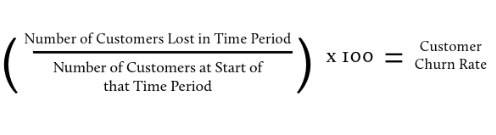

Customer Churn Rate is the percentage of customers who stop doing business with your company over a specific period. It is a critical metric for understanding customer retention and identifying potential product, service, or customer experience issues. The formula for calculating churn rate is:

1. Number of Customers Lost: The total number of customers discontinuing their relationship with your business during a specific period.

2. Total Number of Customers at the Start of the Period: The total number of customers your business had at the beginning of the period for which you're calculating the churn rate.

For example, if you started the quarter with 1,000 customers and lost 50 customers during that period, your churn rate would be:

Churn Rate = (50 / 1,000) x 100 = 5%

In this example, your quarterly churn rate is 5%, meaning you lost 5% of your customer base during that period.

Acceptable churn rates can vary by industry, but here are some general benchmarks:

- Ecommerce: 5-10% monthly churn

- SaaS: 5-7% annual churn

- Telecommunications: 1-2% monthly churn

- Retail: 5-10% annual churn

To minimize churn, improve product quality, provide excellent customer support, and proactively address customer concerns or complaints.

Special Considerations on Churn Rate

Ecommerce: 5-10% monthly churn

- At a 5% monthly churn rate, a company with 1,000 customers would lose 50 customers in the first month, 47 in the second month (5% of 950), and so on. After 12 months, the company would have about 540 customers, a 46% decline.

- At a 10% monthly churn rate, the same company would lose 100 customers in the first month, 90 in the second month (10% of 900), and so on. After 12 months, the company would have about 282 customers, a 72% decline.

SaaS: 5-7% annual churn

- At a 5% annual churn rate, a company with 1,000 customers would lose 50 customers over the year. After five years, the company would have about 774 customers, a 23% decline.

- At a 7% annual churn rate, the same company would lose 70 customers over the year. After five years, the company would have about 696 customers, a 30% decline.

Telecommunications: 1-2% monthly churn

- At a 1% monthly churn rate, a company with 1,000 customers would lose ten customers in the first month, 9 in the second month (1% of 990), and so on. After 12 months, the company would have about 887 customers, an 11% decline.

- At a 2% monthly churn rate, the same company would lose 20 customers in the first month, 19 in the second month (2% of 980), and so on. After 12 months, the company would have about 785 customers, a 21% decline.

Retail: 5-10% annual churn

- At a 5% annual churn rate, a company with 1,000 customers would lose 50 customers over the year. After five years, the company would have about 774 customers, a 23% decline.

- At a 10% annual churn rate, the same company would lose 100 customers annually. After five years, the company would have about 590 customers, a 41% decline.

It's important to note that churn rate should be considered in the context of a company's growth rate. If a company gains more customers than it's losing, it can still grow despite churn through the benefits of a negative net churn rate.

Net churn rate = (Customers lost - New customers) / Total customers at the start of the period

If a company gains more customers than it loses, the net churn rate will be negative, indicating growth. For example, if a company starts with 1,000 customers and loses 50 but gains 100 new customers, the net churn rate would be -5% [(50 - 100) / 1,000], meaning the company grew by 5%.

Therefore, while minimizing churn is crucial, focusing on customer acquisition and growth is equally important. A company with a high churn rate can still thrive if it can acquire new customers and increase revenue from existing customers faster than its losses. Conversely, a company with a low churn rate may struggle if it's unable to attract new customers.

Final Note on Churn Rate - Revenue Churn Vs Percentage Churn

While churn rate is important, it's also vital to note which customers it is indicative of. Sometimes, having a larger churn may not mean net negative revenue. For instance, losing lower LTV customers while growing higher LTV customers still leads to a strong business as long as the net revenue difference between the two groups isn't negative. In contrast, losing a higher volume of high LTV customers can be disastrous for a business, even at smaller percentages. So, in addition to churn rates, you should monitor revenue churn instead of just the percentage of customer churn.

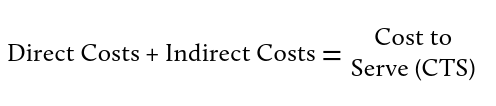

Cost to Serve

Cost to Serve is the total cost of providing ongoing service to existing customers. This calculation includes expenses related to customer support, account management, maintenance, upgrades, and other services required to maintain customer relationships. Understanding your Cost to Serve helps you optimize your resources and ensure that you provide value to your customers while maintaining profitability. The formula for calculating Cost to Serve is:

Gathering, Monitoring, and Analyzing the Data

To accurately calculate and monitor your key metrics, you should set up systems that track your marketing and sales spend, new customers acquired, and revenue generated per customer.

Gathering the Data

Monitoring the Metrics

Analyzing the Data and Understanding the Relationships

Relationship Between Customer Acquisition Costs, Cost to Serve, and the Importance of Payback Period

Customer acquisition costs and cost to serve are direct expenses that determine the remaining profit when subtracted from a client's gross revenue. These costs encompass all expenditures related to acquiring and servicing customers, including marketing, sales, support, and operational costs.

While it is always beneficial to improve CAC, it can be justifiable to have higher acquisition costs if the Lifetime Value of a client is substantial enough to offset these costs. However, the timeline associated with recouping these costs is called the payback period. The payback period is the time it takes to recover the cost of acquiring a customer through the revenue it generates. This metric helps you understand how quickly your customer acquisition investments are paying off and can be used to assess the efficiency of your sales and marketing efforts.

A shorter payback period indicates a more efficient and profitable customer acquisition process, which means you are recouping your investment faster. Tracking your payback period and comparing it to industry benchmarks can identify opportunities to optimize customer acquisition and improve overall profitability. Companies must be wary of overspending on CAC without a timely return, leading to cash flow issues. Improving CAC involves enhancing marketing and sales efficiencies through operational improvements, technological advancements, and statistical analysis.

LTV to CAC Ratio and the Importance of Average Order Value

LTV:CAC Ratio: The LTV:CAC ratio is a powerful metric that compares the lifetime value of a customer against the cost of acquiring them. The ratio helps you assess the sustainability and profitability of your customer acquisition efforts. A healthy LTV:CAC ratio is typically 3:1 or higher, meaning that the lifetime value of a customer should be at least three times the cost of acquiring them. If your LTV:CAC ratio is below this threshold, it may indicate that you are spending too much on customer acquisition relative to the value you are generating, which can negatively impact your business's profitability and growth potential.

Increasing your customers' average order value (AOV) is another powerful strategy for improving your CAC. By encouraging customers to spend extra per transaction, you can offset acquisition costs and improve your LTV:CAC ratio, which is a key indicator of the sustainability and profitability of your business. To increase AOV, consider implementing tactics like upselling complementary products, cross-selling related items, or offering bundled packages that provide greater value to the customer. By strategically increasing the revenue generated from each customer, you can effectively lower your CAC and boost your overall profitability.

The Impact of Churn on Lifetime Value

Churn, or the rate at which customers discontinue their services, directly impacts the Lifetime Value of clients. An increase in churn typically leads to a decrease in LTV, making it a critical metric to monitor. Businesses need to model how variations in churn affect LTV to manage their CAC and CTS effectively. Customers who initially appear profitable can become a financial burden if they do not continue to purchase or upgrade over time, outpacing your CAC and CTS totals. Strategies such as cross-selling and upselling are essential in maximizing existing customers' revenue and counteracting churn's effects.

Balancing Cost to Serve with Customer Acquisition for Sustained Profitability

Improving the Metrics

Reducing CAC

Optimizing your Customer Acquisition Cost (CAC) requires continuous testing, analysis, and refinement. By implementing effective strategies and consistently tracking your CAC, you can improve the efficiency of your customer acquisition efforts, boost your marketing ROI, and drive sustainable growth for your business. Here are some proven strategies for enhancing your CAC:

1. A/B testing ad creative and targeting: A/B testing compares two ad or marketing asset versions to determine which performs better. By continuously testing and optimizing your ad creative, messaging, and targeting, you can identify effective combinations that resonate with target audiences and improve conversions. This data-driven approach to optimization helps you allocate your marketing budget more efficiently, reduce wasteful ad spend, and ultimately lower your CAC. To get the most out of A/B testing, test one variable at a time, use a large enough sample size, and run tests for sufficient durations to gather statistically significant results.

2. Optimizing marketing channels and sales tactics: To improve your CAC, it's crucial to regularly analyze the performance of your marketing channels and sales tactics. By identifying the most cost-effective options that deliver the best customer acquisition and ROI results, you can focus your efforts and budget on the channels that drive the most value for your business, like high-performing channels such as search engine marketing, social media advertising or email marketing while scaling back or eliminating underperforming channels. Continuously monitoring and adjusting your channel mix and sales strategies based on data-driven insights ensures that you always optimize for peak performance and minimize customer acquisition costs.

3. Improving conversion rates at every stage of the pipeline: Improving your conversion rates is one of the most effective ways to lower your CAC, as it reduces the number of prospects you need to acquire to generate a paying customer. Optimize your website, landing pages, and sales funnel to boost conversion rates, remove friction, and encourage visitors to take desired actions. Optimization means streamlining your checkout process, improving site speed and usability, or implementing persuasive techniques like social proof, personalization, and clear calls to action. By continuously testing and refining your conversion optimization strategies, you can significantly improve the efficiency of your customer acquisition efforts and reduce your CAC over time.

4. Increasing average order value: Increasing your customers' average order value (AOV) can be a powerful strategy to improve customer acquisition cost (CAC) as a percentage of their initial sales contract. By encouraging customers to spend more per transaction, you can offset the cost of acquiring them and strengthen your LTV:CAC ratio, an essential indicator of your business's sustainability and profitability. To increase AOV, you can try tactics such as upselling complementary products, cross-selling related items, or offering bundled packages that provide greater value to the customer. By strategically increasing the revenue generated from each customer, you can effectively lower your CAC and boost your overall profitability.

5. Implementing referral programs: Referral programs are a highly cost-effective way to acquire new customers by leveraging the power of word-of-mouth marketing. By encouraging your existing customers to new business, you should tap into a valuable source of high-quality leads more likely to convert and remain loyal over time. To incentivize referrals, consider offering rewards like discounts, buy one get one free, or loyalty points to customers who refer new businesses. Referred customers can have higher lifetime value and lower acquisition costs compared to customers acquired through other channels, making referral programs a powerful tool for improving your CAC.

Improving targeting to attract higher-value customers is another crucial strategy. By identifying the characteristics and behaviors of the most profitable customer segments, businesses can tailor their messaging and offerings to resonate with these high-value prospects, ultimately driving down CAC.

Other strategies for improving CAC include:

- Retargeting campaigns to re-engage prospects who have yet to convert, keeping your brand top-of-mind and nudging them to complete their purchase.

- Leveraging user-generated content and social proof to build trust and credibility with potential customers, reducing perceived risk and increasing conversion rates.

- Optimizing your pricing strategy to attract and retain high-value customers ensures that you maximize revenue and profitability while remaining competitive in your market.

- Investing in organic content marketing to attract and nurture leads, providing value to potential customers, and establishing brand authority in your industry.

- Improving your website and sales funnel to increase conversion rates

- Implementing referral programs to leverage word-of-mouth marketing

- Focusing on increasing customer lifetime value and customer retention

- Creating self-service online sales programs for new customers to purchase without labor costs when it doesn't provide additional value to have a sales rep, such as simple sales processes

- Incentivizing sales team bonus structures around company-wide metrics like profitable customers and low customer acquisition cost metrics, not just volume of sales or revenue

- Engaging process experts to streamline the sales process and reduce the cost per acquisition.

By automating repetitive tasks, improving lead qualification, and optimizing the sales funnel, businesses can minimize the time and resources required to close each deal.

Increasing LTV

Increasing each customer's lifetime value is another critical lever for improving profitability. Implementing tactics to reduce churn and retain customers longer is one of the most effective ways to achieve this. Businesses can minimize attrition and extend the average customer lifespan by proactively addressing customer pain points, delivering exceptional service, and continuously improving the product experience.

Another powerful strategy is increasing revenue per customer through cross-sells, upsells, and price optimization. Businesses can maximize each customer's value by identifying opportunities to expand the customer relationship and delivering targeted offers at the right time. Improving onboarding and customer support can also drive significant improvements in LTV. Businesses can foster long-term loyalty and advocacy by setting customers up for success from the start and providing ongoing assistance and education.

Minimizing Churn