Customer acquisition cost is an easy metric to calculate that organizations use to assess the health of their revenue operations. However, improving that value is more complex than it may seem. Universal Creative Solutions has been helping businesses improve customer acquisition cost (CAC) through various marketing and sales operations consulting and management services for over 15 years. As a boutique agency specializing in accurately tracking, analyzing, optimizing channel mix modeling, and improving sales processes and effectiveness to lower costs, Universal Creative Solutions has supported numerous businesses, deploying omnichannel marketing and advanced sales strategies that maximize resources and drive unprecedented results. In this article, we'll share some insights we've gained from our extensive experience helping clients reduce their customer acquisition cost and scale more efficiently.

Definition and Importance of Customer Acquisition Cost (CAC)

Customer Acquisition Cost represents the total cost of winning a new customer. It includes all sales and marketing expenses directly attributed to acquiring a new customer. The formula for CAC is the total marketing and sales costs divided by the number of clients acquired during that time.

It's important to include all relevant expenses in the "Total Cost of Sales and Marketing," such as:

- Salary costs, commissions, and any benefits for sales and marketing staff

- Advertising and promotion costs

- Content creation and distribution expenses

- Event and trade show costs

- Technology and software expenses (e.g., CRM, marketing automation)

- Overhead costs allocated to sales and marketing

Special Considerations for CAC

There are two crucial factors to consider when decreasing customer acquisition cost. The first is, in your attempts to reduce the customer acquisition cost, are you also pulling in the right customers that will drive the most significant lifetime value to your organization? If you strictly look at the numbers, sometimes you can simply lower marketing costs, and you may still end up with the same number of customers, at least for a time. You've achieved your CAC reduction, but at what cost? Are fewer people going to be aware of your brand? Did you cut out a channel that has correlated effects several months down the line that will only show outside of your immediately reduced calculation?

Another potential challenge is if you reduce spending in an area that brings in customers who provide you with the largest lifetime value. If your organization has a wide variety of price points in their products or services and your target market doesn't have considerable overlap between that range of purchase prices, your CAC reduction may mean bringing in more customers that will pay less over time than growing the customer base supporting larger revenue growth.

Like many metrics, CAC can't be examined in a vacuum. Addressing all potential knock-on effects of improving customer acquisition cost requires a much more complex system of calculations that tracks changes and their correlated effects over time. We specialize in developing systems like that so that businesses of any kind can make accurate data-driven decisions.

The second most important factor in reducing CAC is whether you need only a time-bound approach or should also consider a tactic-bound approach in your calculations. Depending on the level of detail in your marketing and sales attribution modeling, CAC may need to be viewed in several ways.

The traditional view of CAC is the number of customers acquired during a set period of time with the money spent during that time-bound period. However, that only accounts for industries with short sales cycles. Companies with larger sales cycles may be misattributing improvements in customer acquisition cost to tactics that didn't influence the purchase. Unless you didn't change your marketing or sales tactics meaningfully during this time, you should calculate CAC in an additional way.

Another way of reviewing CAC is by directly comparing customers acquired from a specific marketing or sales tactic, regardless of time. By monitoring the original costs associated with the customer's journey, regardless of time, your team can better tell what marketing and sales tactics worked to capture customers. Without this secondary look, your teams may be chasing the wrong tactics, which will further confuse the data when your continued actions don't further improve CAC.

Reviewing both methods of calculating your acquisition costs helps you answer two questions instead of just one:

Is my company lowering overall customer acquisition cost / bringing in profitable customers, and, more importantly, which tactics bring in the best customers at the lowest CAC?

While companies with short sales cycles may get away with only needing to view CAC with a time-bound calculation, others may consider adding the more encompassing view to ensure their teams have the correct data to make the best long-term decisions.

Customer Acquisition Cost Examples

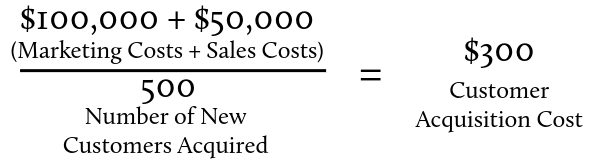

For several examples of calculating customer acquisition cost, we look at several organizations, their spending, and the number of customers acquired in the traditional time-bound method of reviewing CAC. If a company spends $100,000 on marketing and $50,000 on sales in a quarter and acquires 500 new customers in that same period, its CAC would be $300:

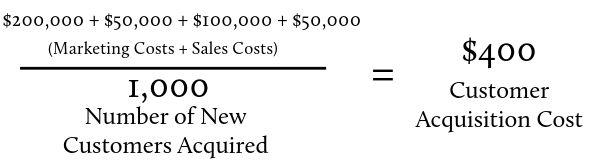

Here's another example: A SaaS company spends $200,000 on Google Ads, $50,000 on marketing salaries, $100,000 on sales salaries + commissions, and $50,000 on sales technologies in a year. If they acquire 1,000 new customers that year, their CAC would be $400:

Tracking and optimizing CAC is crucial because it supports your business in several ways:

1. Profitability: The lower the CAC, the more profitable each new customer is, assuming all other costs remain stable.

2. Scalability: Businesses can scale more efficiently by finding cost-effective channels and tactics while eliminating things that aren't working or driving up CAC without increasing the lifetime value of the customers acquired.

3. Benchmarking: Monitoring CAC allows companies to compare their performance against industry standards, though we always love it when we can do better than the industry averages for our clients.

4. Budgeting and forecasting: Understanding CAC helps businesses allocate budgets and forecast growth more accurately when combined with other key metrics to build a detailed forecasting strategy.

While customer acquisition cost is just a general metric, it is an important benchmark and KPI your organization should regularly report on, monitor, and optimize.

Factors Affecting Customer Acquisition Cost

Like many metrics, there are factors impacting customer acquisition cost both inside and outside your control. Through our work with diverse clients, we've identified several key factors that affect a company's CAC and how to address them, including:

Marketing Factors

Target market and audience: The more targeted and relevant the audience, the lower the CAC tends to be. Defining the ideal customer profile and market segmentation can help focus marketing efforts and reduce acquisition costs.

Marketing channels and tactics: Different channels, such as paid ads, content marketing, or events, can have vastly different costs and returns. Continuously testing and optimizing the marketing mix is crucial for minimizing CAC while maintaining revenue growth. Remember to consider the lifetime value of the customers from each of those channels to avoid decreasing revenue in the long run, even as you achieve short-term CAC reduction.

Ad creative and landing pages: Compelling ad copy and well-designed landing pages can significantly improve conversion rates and lower CAC. A/B testing and conversion rate optimization are vital strategies for enhancing marketing performance.

Sales Factors

Length and complexity of sales cycle: Longer sales cycles with multiple decision-makers tend to have higher CACs. Streamlining the sales process and reducing the time to close can significantly lower acquisition costs.

Sales team performance: The efficiency and effectiveness of the sales team directly impact CAC. Investing in sales training, coaching, and tools can improve conversion rates and reduce acquisition costs.

Pricing and discounting: The company's pricing strategy and discounting practices affect CAC. Offering too many discounts can erode margins, while optimized pricing can attract the right customers at a sustainable cost.

Lack of self-service model: Some customers want or need to work directly with your sales teams, while others may prefer to purchase directly. Depending on the complexity of your products and services and the customer's history with your firm, you may want to explore the opportunity to automate sales to reduce costs.

Other Factors

Balancing Internal & External Resources: Since acquisition costs include labor costs within your marketing and sales department, it's vital to examine how you balance resources, workload, and the differences in costs for in-house services vs. contractor or agency work. Ensure you're using outside services when scale and workload balancing are an issue, not as a permanent solution when in-house costs could be more affordable.

Competitive landscape: Companies should invest more to differentiate themselves and win customers in highly competitive markets. Monitoring competitors' strategies and positioning can help inform acquisition efforts.

Customer lifetime value (LTV): While not directly impacting CAC, the LTV to CAC ratio is a critical metric for evaluating the sustainability of acquisition efforts. Aiming for a minimum LTV to CAC ratio of 3:1 ensures that the potential long-term value justifies the cost of acquiring customers. Remember, LTV is a measure of profit, not gross revenue. Gross revenue multiples should be significantly higher to remain profitable while allowing for a range of cost-to-service (CTS).

Strategies to Reduce Customer Acquisition Cost

Over the years, we've developed and refined several proven strategies to help our clients reduce their CAC, including:

1. Building self-service models: Implementing self-service options for customers to purchase products and services without requiring direct interaction with a sales team can significantly reduce CAC. By providing clear, user-friendly interfaces and automated onboarding processes, companies can streamline the customer journey and minimize the need for costly human intervention.

2. Leveraging product-led growth: Designing products with built-in viral loops and user-friendly onboarding experiences can drive organic growth and reduce the reliance on traditional sales and marketing efforts. Companies can acquire customers at a lower cost by focusing on delivering immediate value to users and encouraging them to invite others.

3. Optimizing the sales process with technology: Implementing sales automation tools, such as CRM systems, proposal software, and e-signature solutions, can streamline the sales process and reduce the time and effort required to close deals. Companies can lower their CAC and scale more effectively by eliminating manual tasks and improving the sales team's efficiency.

4. Implementing account-based marketing (ABM): For B2B companies targeting high-value accounts, ABM can be a cost-effective approach to customer acquisition. Companies can create personalized campaigns that drive higher conversion rates and lower CAC by aligning sales and marketing efforts to focus on specific accounts and decision-makers.

5. Better segmenting and targeting ideal customers: By clearly defining target audiences and segmenting them based on demographics, behaviors, and needs, we create more relevant and effective marketing campaigns that drive higher conversion rates at a lower cost.

7. Improving conversion rates through landing page optimization: We ensure landing pages are clear, compelling, and optimized for conversions, using persuasive copy, strong calls-to-action, and social proof to encourage visitors to take the desired action.

8. Utilizing cost-effective channels: While paid advertising can be effective, it's often the most expensive channel. We carefully balance the need for advertising against organic results to supplement paid efforts with more cost-effective channels like content marketing, SEO, and email marketing to attract and nurture leads at a lower cost. Advertising directly above successful organic results is generally only necessary if you're trying to increase brand awareness.

9. Focusing on customer retention and increasing lifetime value: Acquiring a new customer can be 5-25x more expensive than retaining an existing one. By focusing on customer satisfaction, engagement, and upselling/cross-selling, we help clients increase the lifetime value of each customer and offset acquisition costs.

10. Implementing referral programs: We encourage satisfied customers to refer their friends and colleagues through incentivized referral programs. Referred customers tend to have a lower CAC and higher lifetime value than those acquired through other channels.

11. Continuously testing, measuring, and optimizing: We regularly review CAC and related metrics to identify areas for improvement. By testing new strategies and tactics, measuring their impact, and optimizing approaches based on the results, we drive continuous improvement for our clients.

Driving Profitable Growth Through Optimized Customer Acquisition

Throughout this article, we've explored the critical importance of Customer Acquisition Cost (CAC) and the various factors that influence it, from sales cycle length and team performance to marketing channels and audience targeting. By understanding these factors and implementing proven strategies to optimize them, businesses can significantly reduce their CAC and drive more profitable growth.

Our 15 years of experience at Universal Creative Solutions have given us a deep understanding of the most effective approaches to improving CAC using proven modern strategies. We've seen firsthand the impact of implementing self-service models, leveraging product-led growth, optimizing sales processes with technology, and employing account-based marketing. We've also witnessed the power of better audience segmentation and targeting, ad campaign optimization, landing page improvement, and cost-effective channels like content marketing, email marketing, and SEO.

Moreover, we've helped clients understand the importance of focusing on customer retention, increasing lifetime value, and the benefits of implementing referral programs to acquire customers at a lower cost. By continuously testing, measuring, and optimizing these strategies, we've driven significant improvements in CAC and overall business performance for our clients.

If you're ready to control your customer acquisition cost and unlock your business's full potential, contact Universal Creative Solutions today. Our team of experts is prepared to help you analyze your current situation, identify opportunities for optimization, and develop a customized strategy to achieve your goals. Together, we can help you drive the profitable growth your business deserves.