Customer churn rate is a standard business metric used to assess the loss of customer base or loss of revenue in a revenue churn calculation. These calculations detail the percentage of customers who stop doing business with a company or revenue lost over a given time without considering customers or revenue gained. High churn rates can severely impact a company's growth, profitability, and long-term sustainability. Churn rate is a good indicator of how customers feel about your business, and when paired with exit surveys, they can provide you with the details you need to improve your business and lower your churn rate.

At Universal Creative Solutions, we have extensive experience helping businesses across various industries improve their operations, marketing results, and customer experience through organized data and insightful analysis. To achieve long-term success, this level of management is necessary to capitalize on the full value of your data. That's where our consulting firm comes in - we work hand-in-hand with clients to develop data-driven strategies that reduce churn, improve efficiency, and fuel sustainable growth.

Surprisingly, many strategies that reduce churn don't start with the customer but rather with your internal team and processes. If you don't have established operations, including training and onboarding, previous results are less likely to be reproduced over time. Furthermore, lack of clarity makes teams work harder than they need to and can burn out your best employees. While we're primarily focused on what churn is, how to calculate it, and how to reduce churn from a customer perspective, it's important to remember that a company's results are the sum of its people's actions. Customer Churn Rate merely reflects those actions' impact or lack thereof.

What is Customer Churn Rate (CCR)?

Customer churn rate (CCR) is the percentage of customers that stop doing business with a company over a defined time period, such as a month, quarter, or year. For SaaS businesses, churn refers to the percentage of subscribers who cancel their recurring subscriptions. For traditional product companies, the churn rate evaluates the percentage of customers who don't make a repeat purchase within the expected time frame or that you can verify will not purchase again. The churn rate in and of itself does not include any metrics for growth as we might calculate for a net churn rate. Churn helps organizations identify unsatisfied customers regardless of overall growth and should acted on for its own merits and purposes in addition to net calculations that include growth metrics.

A high churn rate indicates that a significant portion of the customer base is dissatisfied with the product, service, or customer experience and will no longer purchase from your company. Reduced customer bases not only lead to an immediate loss of revenue but also put a strain on new customer acquisition to replace the lost business in addition to supporting growth.

The churn rate is especially problematic for businesses reliant on recurring revenue models, like SaaS companies and subscription services. In these business models, even small increases in monthly churn rates can have a compounding effect over time, dramatically impacting growth and profitability. For instance, a company with a 10% churn rate per quarter would lose its entire customer base in two and a half years without acquiring new customers. While customer acquisition should be a key strategy for your business, even if your acquisitions drop that churn rate in half, you only have five years of runway before the company no longer exists in its current form.

Consider the challenges a business has along a relatively steep decline like that

- losing employees to layoffs,

- potentially losing vendors if accounts payable have to push back payment schedules and

- cost-cutting some potentially beneficial tools for the organization which could decrease efficiency.

Ultimately, the organization would likely go out of business sooner than the simple calculation shows, and a lot of that timeline depends on the profit margins, which churn doesn't account for. Additionally, since churn most often focuses on customers, it's essential to consider if high-revenue customers are leaving vs. low-revenue customers since your reaction to either condition would be different.

Note how the churn rate is the inverse of the retention rate. Retention rate measures the percentage of customers who remain with the business over time. So, a monthly churn rate of 5% is equivalent to a monthly retention rate of 95%. Companies should track and work to minimize churn rate while maximizing retention rate for long-term success, but revenue-based churn and retention models should also be considered for a more nuanced understanding. Understanding why customers churn and how best to retain them is the first step to developing effective strategies to reduce churn.

How to Calculate Customer Churn Rate

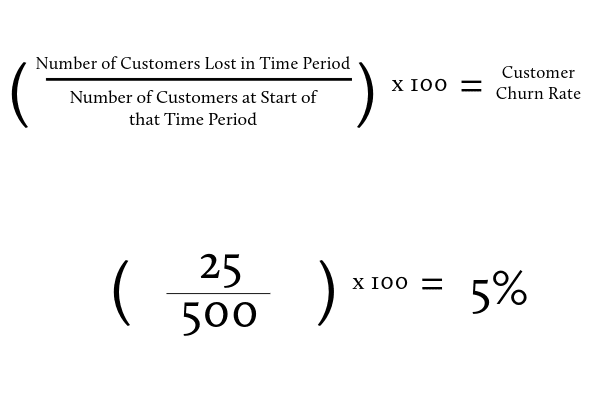

The formula for calculating customer churn rate is:

(Number of Customers Lost in Time Period / Number of Customers at Start of that Time Period) x 100

Let's walk through an example calculation. Suppose your SaaS business started the quarter with 500 customers. Over the course of the quarter, 25 customers canceled their subscriptions.

To calculate your quarterly churn rate, you would divide 25 by 500 and multiply by 100:

(25 / 500) x 100 = 5%

So, in this example, your quarterly customer churn rate is 5%.

Churn rate can be calculated for different periods such as monthly, quarterly, or annually. The choice depends on your business model and how frequently you bill customers. For example, a subscription box company that charges monthly might track churn on a monthly basis, while an enterprise SaaS provider with annual contracts would calculate yearly churn. Additionally, report on churn from the same date across multiple time values to see how churn changes over time. For instance:

- If you see increasing values for time periods closest to the reporting date, your efforts, or lack thereof, may be increasing churn.

- Average churn for the last 12 months: 4%

- Average churn for the last quarter: 6%

- Churn for the last month: 10%

- Your efforts may be improving churn if you see decreasing values for time periods closest to the reporting date.

- Average churn for the last 12 months: 8%

- Average churn for the last quarter: 5%

- Churn for the last month: 3%

Keep in mind that new customers may have a different churn rate than existing long-term customers. It's important to look into any patterns you can find to ensure these increases or decreases in churn aren't just part of a fluctuation in the churn between cohorts.

Special Considerations For Customer Churn Rate (CCR)

It's important to note that customer churn rate differs from revenue churn rate. While customer churn looks at the number of customers lost, revenue churn measures the percentage of recurring or expected revenue lost in a period. Revenue churn accounts for factors like customers downgrading to lower-priced plans. A business can have a low customer churn rate but a high revenue churn if it's losing high-value customers.

Revenue Churn

Revenue churn is another great metric to calculate, in addition to churn rate, to provide some extra details on which solutions you need to try to solve the problem or if there is a problem at all. For instance, if your company has greater profit margins on high revenue accounts due to a lower percentage of cost to serve (CTS), losing lower revenue accounts may not matter to your organization very much and could even help the bottom line no matter the churn rate.

Conversely, if you have something like a low-cost subscription model that's self-service based, meaning you spend little to nothing in cost-to-serve (CTS), and you're only losing high-revenue high cost to serve clients, you may prefer the easy revenue and not worry about a few significant revenue account loses from time to time. It all depends on your organization's goals and the current churn rate conditions you face.

For some advanced churn calculations, you may want to consider profit churn. Similar to revenue churn rates, if you have data on how profitable each customer is to your organization, you can analyze how much impact those losses have on your bottom line.

Negative Churn

There is also a concept called negative churn, also known as net negative churn or negative revenue churn. It occurs when the additional revenue generated from existing customers through expansions, upsells, cross-sells, etc., exceeds the revenue lost from cancellations and downgrades in a given period.

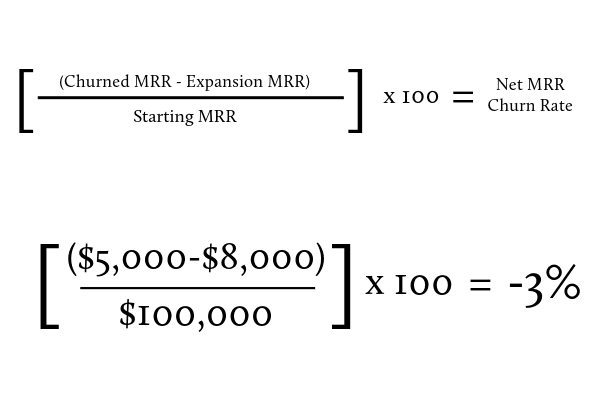

The calculation used to determine if a company has achieved negative churn is:

Net MRR Churn Rate = [(Churned MRR - Expansion MRR) / Starting MRR] x 100

If the result is a negative percentage, the company has negative churn for that period, which is essentially growth without requiring new acquisition revenue/customers.

For example, let's say a company's MRR at the beginning of the month is $100,000. During the month, they lost $5,000 in MRR from cancellations and downgrades but gained $8,000 in expansion MRR from existing customers upgrading or purchasing add-ons.

The calculation would be: [($5,000 - $8,000) / $100,000] x 100 = -3%

The negative result indicates the company had a 3% negative net MRR churn rate that month, meaning the expansion revenue from existing customers more than offset the revenue lost to churn.

Achieving negative churn means a company can grow without acquiring new customers, which is ideal for subscription businesses.

A Warning on Negative Churn-Focused Businesses

While all products and services have a lifecycle, and at one point, the cycle may indicate the business needs to solidify as much value as possible before it's no longer a profitable product line, organizations that are overly focused on achieving negative churn may no longer be providing additional value to their customers. While some add-ons or value-capture ideas may improve customer experience and the overall value of your product, there are many psychological tricks or cheap optimization strategies that companies deploy to extract value out of a customer.

People build organizations because they see a need in a market and believe they can create value in solving that need for the customer. Great companies continue to monitor the market to develop products and services that provide significant and expansive value to their customers. Organizations that are almost entirely focused on achieving a net negative churn through cheap tricks instead of attempting to provide clear value to the customer may ultimately be companies in decline. Even if you have a pricing strategy team, make sure they are paired with the market research team, sales teams, and R&D/Product Development so that they are working on both optimizing existing lines and pricing for new opportunities for your organization and your customers.

Why Reducing Churn Rate Matters

Reducing the churn rate is critical because high churn hurts revenue, profitability, and growth. When you lose customers, you lose the recurring revenue they provide. You also incur higher costs in acquiring new customers if you need to replace existing customers as well as grow the customer base. Studies have shown it's significantly more expensive to acquire new customers rather than retain existing ones.

In contrast, a low churn rate reflects high customer satisfaction and business stability. Loyal, long-term customers tend to spend more over their lifetime and are more likely to refer new business. According to a Bain & Company theory, a 5% increase in customer retention can increase profits by 25% to 95%. So, even small reductions in churn rate can have an outsized impact on profitability and growth.

Strategies to Reduce Customer Churn Rate

While some companies focus on reducing churn by adjusting external offerings and messaging, the vast majority of improvements will come from within. Customers experience a company from the people and processes those organizations follow. So, we recommend starting with internal optimization through better training, empowering teams to resolve issues, establishing strong operations, including SOPs, and automating operations as much as possible. By providing standard operating procedures and automating where possible, your team can better fulfill the customer's needs consistently and provide feedback where processes need to be improved or results were not as expected.

1. Improve onboarding to deliver value quickly

A smooth, effective onboarding process is one of the best ways to set customers up for success and reduce early churn. Focus on delivering value quickly by guiding users through key features, providing interactive tutorials, and offering personalized support. For traditional businesses, effective onboarding establishes how the customer feels about your brand and can extend the lifetime value of the clients by establishing a strong foundation. No one likes being sold a product or service enthusiastically only to have the company drop the ball when it comes time to fulfill the services. By helping customers engage with the benefits of your product or service from the start, you increase the likelihood of long-term retention.

2. Engage proactively with personalized communication

Don't wait for customers to reach out with issues or questions. Proactively engage them with personalized communication based on their behavior and preferences. Use targeted emails, in-app messages, or direct outreach to provide relevant information, tips, and support. Show customers that you value their success and invest in their experience with your brand. Not hearing customer complaints doesn't necessarily mean everything is going smoothly. In fact, once they have decided you aren't supporting their needs, the silence is probably evidence of them researching other options to leave than happy customers. Ensure you actively engage one-on-one with your customers to maintain the relationship.

3. Gather customer feedback regularly to uncover issues early

Regularly seek customer feedback to identify potential issues or pain points before they escalate into reasons for churn. Use surveys, customer interviews, or user testing to gather insights on their experience, satisfaction levels, and areas for improvement. Act on this feedback to proactively address concerns and show customers their input is valued. You should develop or follow a continuous improvement cycle like our 4 imPERAtives: Plan, Enact, Review, Adapt. If your business can't take customer feedback, turn that into actionable plans, and execute those plans successfully, you may want to improve your operations.

4. Provide excellent, responsive customer service

Exceptional customer service supports drastically reducing churn. Equip your support team to handle inquiries promptly, efficiently, and empathetically. Offer multiple channels for customer support, such as email, phone, live chat, or social media. Aim for quick response times and satisfactory resolution of issues to build trust and loyalty. The best way to ensure customer service is efficient and effective is to give them the power and accountability to resolve issues promptly.

Every time a user calls the company, they should be able to resolve the problem without further follow-up. To accomplish that, you need to layer your support and connect the support team members by enabling simple solutions or immediate call transfers to higher-level resolution specialists if the initial call team cannot resolve the problem. When you see patterns of issues that require higher level resolution, it may be time to empower the initial call team to resolve that issue as well through additional training or permitting them to make decisions on those support solutions without having to transfer.

5. Analyze churn reasons and focus retention efforts on high-value, at-risk customers

Dive deep into the reasons behind customer churn by analyzing data from cancellation surveys, feedback surveys, and customer interactions. Identify common patterns or triggers that lead to churn. Use this insight to proactively reach out to high-value customers who exhibit similar risk factors. Offer personalized support, incentives, or solutions to address their needs and prevent them from churning. Meanwhile, attempt to resolve that issue at the root cause. Put together a plan to address the challenges churning customers face and continue to track churn reasons until you have successfully reduced the number of customers that mention the previous churn reasons.

6. Continuously enhance your product based on feedback

Keep your product or service competitive and aligned with customer needs by continuously gathering and acting on user feedback. Regularly update and improve your offering based on insights from customer surveys, feature requests, and user behavior data. Demonstrate to customers that you are committed to their success by delivering enhancements that address their pain points and provide additional value. You may even want to share your roadmap with them so they understand you are turning their feedback into meaningful action. Let the user follow the aspects of the roadmap that are most important to them. That way, they aren't overwhelmed with updates other than the ones they care about.

7. Offer incentives and loyalty programs

Reward your customers for their continued business with incentives and loyalty programs. Offer perks like exclusive discounts, early access to new features, or bonus content to make them feel valued and appreciated. Implement a tiered loyalty program that increases benefits based on the length or value of the customer relationship. These initiatives can help foster long-term commitment and reduce the likelihood of churn. Additionally, work on pricing structures that increase the value or amount provided for volume and at scale. That way, as customers learn to trust your brand, they can receive even more value by engaging more frequently or deeply with your products and services.

These different tiered programs are a great way to understand your base pricing and gather feedback on customer satisfaction at various price points and perks. If something is super popular as an add-on service, consider providing it out of the box to attract even more new customers at a higher base rate rather than burying it in a loyalty or incentive program that only some engage with.

Churn Rate Benchmarks by Industry

While every business is unique, it can be helpful to understand typical churn rates within your industry to gauge your performance and set realistic goals. Ultimately, the goal should be to get the churn rate as low as possible by delivering ongoing and increasing customer value. SaaS companies should aim for 5-7% annual churn, which is considered a good benchmark, but churn rate by industry varies. Base your ideal churn rate on your business model, growth stage, and relevant benchmarks for your industry to ensure the organization is on track. The key is to continually measure churn, understand why customers are leaving, and take action to improve retention over time.

Here are some average churn and retention rates for various industries according to customer gauges:

- Energy / Utilities: 11% Churn / 89% Retention

- IT Services: 12% Churn / 88% Retention

- Financial Services: 19% Churn / 81% Retention

- Professional Services: 27% Churn / 73% Retention

- Telecommunications: 31% Churn / 69% Retention

It's important to note that these numbers are averages and can vary significantly based on factors like company size, target market, and business model. Additionally, as highlighted in this article, the churn rate doesn't always perfectly equate with revenue churn, and even if you are losing some customer base, you may still have a net negative revenue churn driving growth. A company targeting enterprise clients may have a lower churn rate than one focused on small businesses due to longer contract terms and higher switching costs, but it could still be hurting profitability more if enterprise clients require a higher cost to serve (CTS).

Rather than simply comparing your churn rate to industry benchmarks, it's crucial to determine a sustainable churn rate for your specific business model. Consider your customer acquisition costs (CAC), lifetime value (CLV or LTV), and growth targets to identify a churn rate that allows for profitable, long-term growth. Continuously monitor and work to improve your churn rate relative to your baseline and goals rather than just aiming to match industry averages.

Putting Churn Reduction Strategies into Action

Proactive monitoring and efforts to minimize churn rate are more important than ever for sustainable growth. High churn rates can severely impact revenue, profitability, and the overall health of your business. Understanding factors contributing to churn and implementing targeted strategies to improve retention can set your company up for long-term success.

The strategies we've shared in this article, such as improving onboarding, engaging customers proactively, gathering feedback regularly, providing excellent customer service, analyzing churn reasons, continuously enhancing your product, and offering incentives and loyalty programs, can all help to reduce churn. However, it's important to tailor these approaches to your business model and customer base for maximum impact. While Churn is frequently calculated in SaaS businesses, traditional businesses, which may not be tracking these metrics, can also utilize the data to improve their products and services.

At Universal Creative Solutions, we have extensive experience helping businesses develop simple, easy-to-implement strategies to improve these metrics. Our team can analyze your current churn rate, identify key drivers of customer attrition, and implement targeted solutions to improve retention and drive sustainable growth.

If you want to reduce your churn rate and build a loyal customer base, we invite you to contact us for a free consultation today. We're ready to partner with you to develop a customized churn reduction plan that fits your unique business needs and goals.